For illustrative purposes only

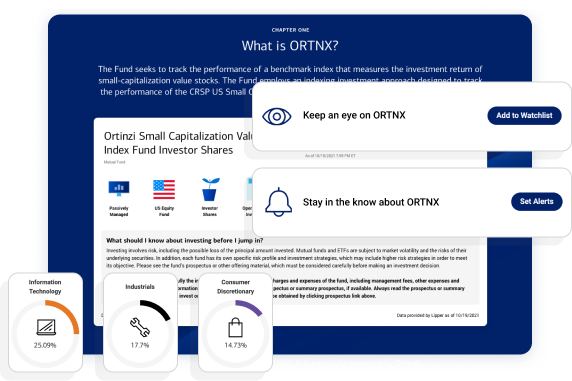

Become a well-informed investor

Gain a comprehensive understanding of a mutual fund with Fund Story, a curated and engaging experience that empowers you to pursue your investing goals while analyzing funds to decide which ones work best for you.

View the holdings making up a fund, monitor performance, evaluate third-party ratings and see how fees are assessed as well as their impact on returns now and over time.